Nothing Happens Until You Sell Something

Originally published on LinkedIn Oct 6, 2020

Part #4 of a multi-part series on Growth, Velocity and Distribution for Emerging CPG Brands

Nothing Happens Until You sell Something…on and off the shelf.

Jim Barksdale is a legendary entrepreneur and business executive who helped shape Federal Express and who was key in Netscape’s success and exit to AOL. He is well known for his colorful and profound statements and coined the first part of this section’s headline appropriately.

Distribution is about selling “the something” on to that shelf and velocity is about selling “the something” off that shelf. And, the two are not mutually exclusive. You need velocity growth to entice buyers to expand and sustainably retain distribution. You need distribution to give you scale. Scale is necessary to reduce COGS, and also to bring in those incremental dollars that you can invest in trade marketing, which in turn can help to increase velocity. Distribution also impacts brand equity as it expands awareness and availability. There is a delicate tension and balance between distribution and velocity growth, and you need both to achieve that lift-off speed that will catapult an emerging brand into the $25 million, $50 million or $100million annual retail sales territories.

The Multiplier Effect of Distribution, Velocity and Price

Financially, the relationship between distribution and velocity is clear. Instead of looking at Sales from just a Quantity × Price perspective, it is instructive to “break out” Quantity into its Distribution and Velocity components.

Large CPG incumbents have often used the Multiplier Effect of Quantity × Price by taking low to mid-single digit annual price increases to “mask” volume declines or to conversely to boost low digit volume growth with small price increases. I have no issue with price increases, unless there is industry collusion. The point I am making here is about the Multiplier Effect of Quantity × Price. For example, a 5% increase in Quantity, coupled with a 5% increase in Price will yield a 10.25% increase in Sales.

Given that retailers work off such thin EBITDA margins to begin with, the multiplier effect of even 0.25% can have a huge impact if that the extra 0.25% can drop straight to the bottom line.

Similarly there is a Multiplier Effect that has a Ramping Impact when you look at Sales = Distribution × Velocity × Price.

The chart above shows the impact of the Multiplier Effect for three different distribution and growth scenarios. (Price is kept constant)

The green curve shows the revenue growth if velocity is growing at half the growth rate of distribution. (E.g. If distribution is growing at 100% YoY and velocity is growing at 50% YoY, then Revenue is growing at 200% YoY)

The orange curve shows the revenue growth if velocity is growing at the same growth rate of distribution. (E.g. If distribution is growing at 100% YoY and velocity is growing at 50% YoY, then revenue is growing at 300% YoY)

The blue curve shows the revenue growth if velocity is growing at twice the growth rate of distribution. (E.g. If distribution is growing at 100% YoY and velocity is growing at 200% YoY, then revenue is growing at 500% YoY)

Note: It is unlikely that velocity will reach or even grow high double or triple digits over a prolonged period of time. The growth rates shown in the chart are purposefully high in order to visually illustrate the Multiplier Effect.

Another way of looking at this Multiplier Effect, for constant pricing, is as follows.

If you are currently growing both your distribution and your velocity at 50% YoY, then your revenue will have grown at 125% YoY. Now, if you had been able to have increased both your distribution and velocity by 51% YoY, your Revenue would have grown by 128% YoY. The incremental 1% YOY growth in distribution and velocity resulted in an incremental 3% YoY increase in Revenue! Over large volumes, even small increments can bring in significant cashflow dollars!

Dr James Richardson's “Skate Ramp” growth pathway [1], is a pathway that his research has shown to mostly represent small the percentage of emerging brands that have been able to achieve a sustainable $100 million in retail sales over a certain period of time. The Skate Ramp pathway is dependent on the compounding effect of exponential growth, which can imply annual sales growth rates of above 100%.

To achieve this type of exponential growth you also need to be able to show high growth rates in velocity and distribution. The Multiplier Effect impact for larger growth numbers has a larger compound effect.

Can your Emerging CPG Brand create a Inverted Price Umbrella?

In the Multiplier Effect graph of the previous section, I kept prices constant (i.e. no price growth). Price growth would obviously also act as a multiplier. A fascinating insight gleaned from Richardson’s [1] work was the following nugget, which he describes as follows:

“The primary lesson I’ve learned from Skate Ramp brands is that you must sustain exponential growth with a premium average-unit price (i.e., post-promo), so that you can slowly lower per-package average retail price as you scale.”

Siggi’s, is a yogurt brand that I consider to be a benchmark and highly respected competitor in the dairy and non-dairy yogurt category. They are a perfect example of how an above-premium price yogurt, post its acquisition by Lactalis, have relaxed prices over the years to capture a mass-premiumization growth path.

Creating an inverted price umbrella for a premium brand is smart, if you have the scale, as it pressurizes existing competitors and new competitive entries. It especially disadvantages companies with inferior products and consumer propositions.

Consider this: If on a year-to-year basis you increase the velocity of your brand by a half (50% growth), double distribution (100% growth), and reduce average retail price by 25%...You will still grow sales by 125%. That is still Skate Ramp territory. Of course number gymnastics are just that, and it takes a lot of smart work by a lot of smart people to achieve success. But it has been done!

It might now make sense why large retailers and distributors absolutely seek and support well managed high velocity premium brands, especially brands that can eventually be mass-premiumized!

So, is there hope for Emerging CPG Brands?

COVID, high failure rates, competitive pressures, low margins. Is there hope? There sure is. But, as is often quoted or even misquoted…Hope is not a strategy. You need a plan. A single-minded, pragmatic and deliberate growth plan. A plan that can dynamically respond to market forces and challenges and that will forge your brand over a prolonged period of time.

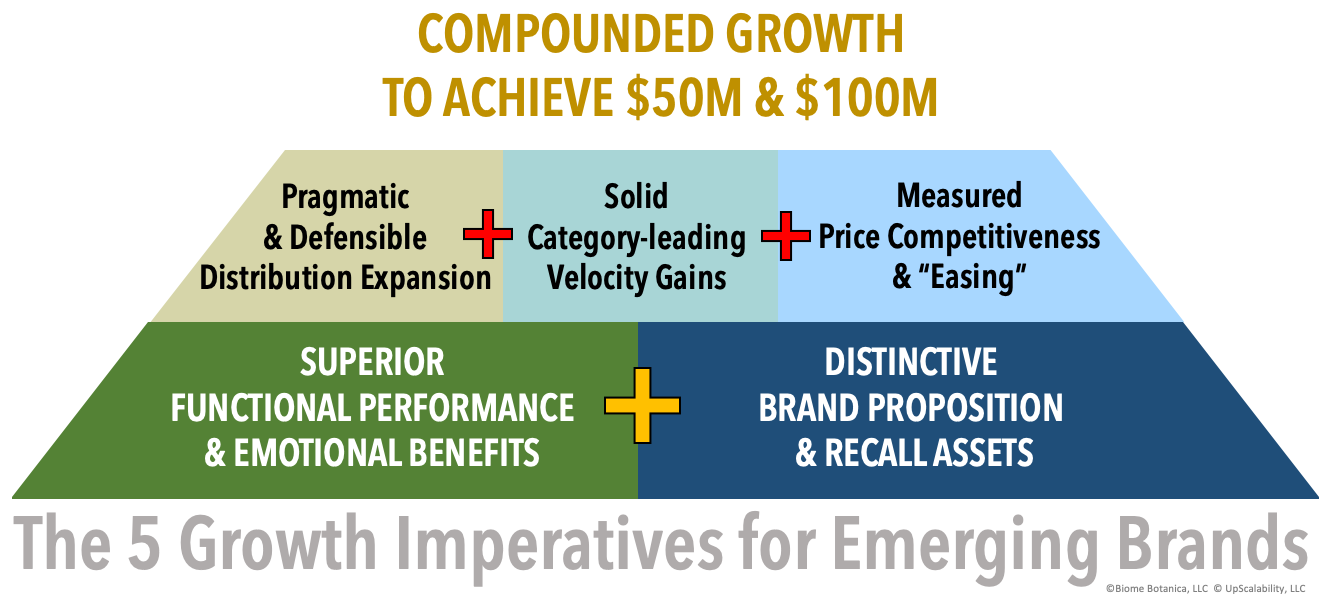

Emerging CPG brands need a growth plans that can address the “HOW” part of achieving the five imperatives highlighted in Part #1, the first article in this series.

Hopefully, some of the content in this series and forthcoming articles addresses some of the “WHY”.

Serial entrepreneur, Samuel whose IWON Organics company revenue grew 300% from 2018 to 2019 [2], and whose business was impacted by COVID, had this to say to Ray Latif of Taste Radio when discussing his own journey:

“I have been lucky enough to win a couple, and I have also been lucky enough to have lost many times. Those are just learning points. We often hear that failures are what move us forward and they provide us context and direction on how we are going to get around the next hurdle.”

The thoughts, references and analogs presented in this series of articles are not meant to discourage, but rather serve to allow for a recalibration and self-reflection. For many this will be validation that you are on the right track.

Facing some hard truths that are shaping the future

For me, it comes down to a few hard truths that are becoming evident and that will influence the success of your emerging brand. Here are a few:

The pandemic has accelerated the massive change that was going to happen anyway. Not just the shift to online. For example, bifurcation with regards to premiumization (and functional benefits) and value-focused pack-size offerings will squeeze those brands and companies caught in the middle.

Innovation and SKU proliferation will continue, as technology and co-packing barriers to entry drop. As a result, an ever-increasing cohort of entrepreneurs will enter the market to satisfy the consumer fragmentation needs and channel blurring dynamics that are taking place. But it will also become harder to get on and to stay on the shelves. Customer Acquisition Costs as they relate to trade marketing expenses, omni-channel marketing will likely increase to the point where they might be higher than ingredient, packaging and direct labor COGS. Margins will decrease. Achieving scale quickly will determine winners and losers.

Shelf-space (even, the virtual shelf) will continue to be constrained. Velocity through that physical or visual constraint determines the profitability and behaviors of all the stakeholders throughout the entire value chain. Artificial Intelligence will soon influence assortment in a way that traditionally category management has struggled to achieve for a long time. And to achieve this, what you will find is the deployment of TikTok-type of AI super-algorithms that will fine-tune and match changing patterns of supply and demand at the store level.

Velocity, its measurement and its management, if not already, will become one of the most important metrics and goals to rally the team behind. Sales Velocity is a start. In the next few years, Margin Velocity will be the determinant of success. (More on this in the next few articles.)

The sales cycles to achieve brand placement on retailer shelves, via resets, are currently out of sync with the rapid change of pace in product innovation, consumer preferences and market/environmental changes. COVID proved that to us, as supply chains struggled to adapt and flex. This will change. Multi-outlet retailers that master this agility will be the Zara of CPG.

References

Richardson, James; Ramping Your Brand: How to Ride the Killer CPG Growth Curve; PGS Press; 2019

Taste Radio Insider Podcast; Ray Latif interview with Mark Samuel (IWON Organics); Episode 98; Sep 18, 2020