Margin Velocity Accounting (MVA)™

What is Margin Velocity Accounting (MVA)™ ?

Margin Velocity Accounting (MVA)™ unmasks the direct financial impact of brand and/or account-level performance trade-offs made with respect to deal pricing, trade promotion activity, distribution/account expansion and brand-SKU velocity (rate of sale).

The Distribution-Velocity Competitive Grid

The Distribution - Velocity Competitive Grid is one of four analyses summary grids that expose the underlying margin performance of a set of Brands or SKUs within a set of set of geographies or accounts.

This grid, for example, shows how distribution reach and velocity momentum has impacted the gross margin for three brands across different retailers.

An advanced analytical approach

Margin Velocity Accounting (MVA) ™ is an advanced analytics, margin analyses methodology that exposes the extent to which gross margin and sales contribution have been directly impacted (or masked) by pricing power, distribution expansion, velocity momentum and cost efficiency.

The methodology is ideal for competitive CPG and consumer goods categories, but can be used in any industry where growth is dependent on:

Smart brand pricing and trade marketing spend that does not dilute brand strength.

Sustainable sales and velocity momentum on a per account/distribution reach basis.

Rational, disciplined distribution reach and account expansion that does not reduce velocity

Targeted improvement of COGS , outbound logistics and trade marketing unit costs.

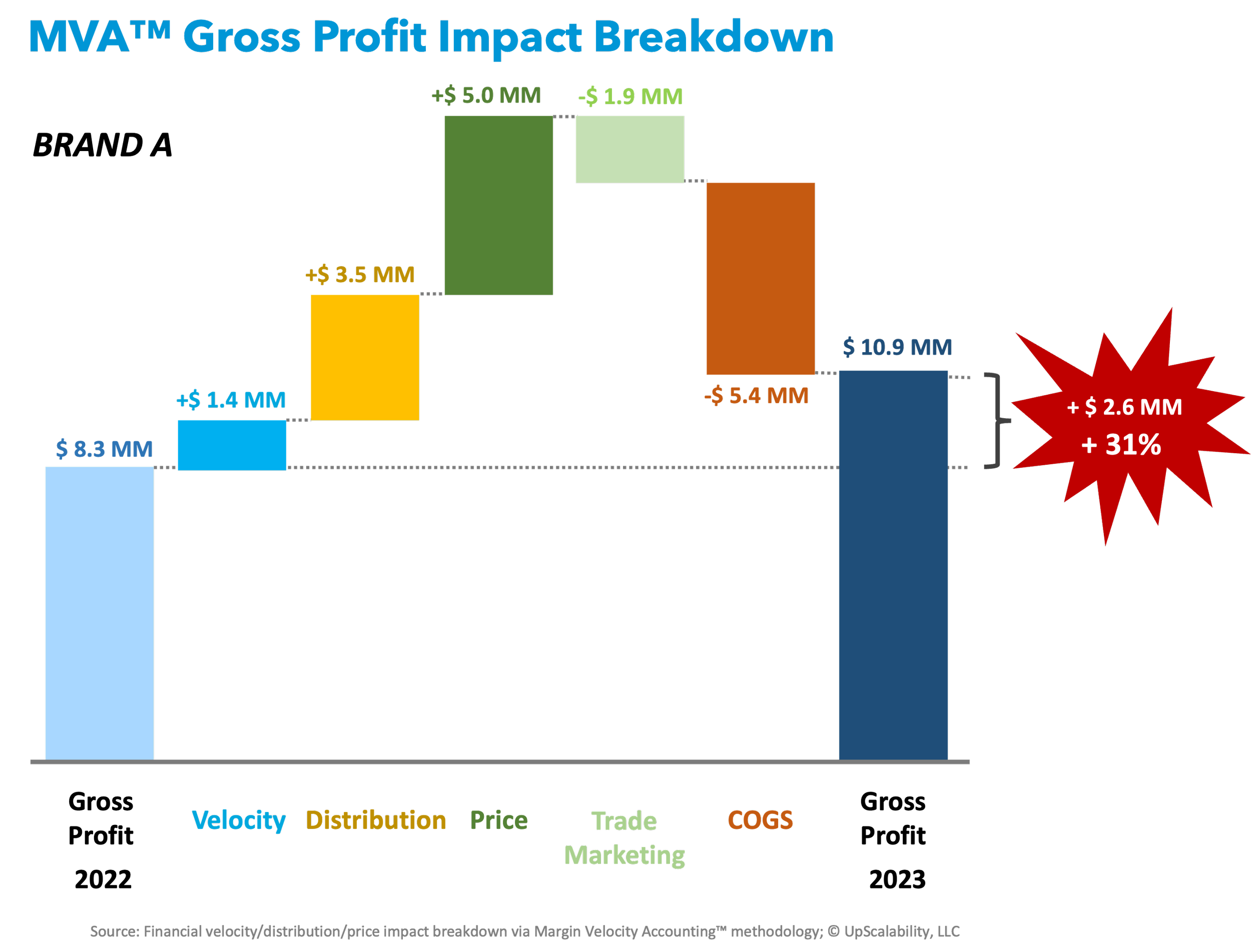

The bar chart below shows how Margin Velocity Accounting (MVA)™ can breakdown the change in gross profit (or any profit level) into the impact derived from changes in velocity, distribution (or penetration), price, trade marketing, COGS (and other costs).

Harnessing the power of syndicated data

The methodology and approach is particularly suited for brands in categories that use data syndicators like IRI, NPD Group, NielsenIQ and SPINS to track account management performance and to explore competitive growth opportunities.

MVA™ enables brands to use retail or B2B velocity, distribution and pricing data to expose their direct financial impact on a brand’s change in gross margin or sales contribution over a period or compared to a budget or target.

Stress testing the achievability of execution plans

The power of MVA™ extends beyond historical reporting. The methodology empowers a market area (or a region on a roll-up basis) to plan a pragmatic roll-out, map a competitive response, stress-test a budget or plan new product/service launch.

How was Margin Velocity Accounting (MVA)™ developed?

Manoli Kulutbanis, managing partner of UpScalability, LLC, has evolved and developed Margin Velocity Accounting (MVA) ™ over the span of his corporate, entrepreneurial and consulting career within the CPG/FMCG industry. The methodology and approach is unique and proprietary to UpScalability, LLC.

See how it works… with your own data

If you are curious how this methodology can enhance your brand’s pricing and margin growth strategy, contact Manoli to discuss the feasibility of exploring one or both of the following:

A kwik ‘n dirty analyses using syndicated data for 2-4 SKUs, three retailers/wholesalers in two geographies.

A more robust pilot analyses that covers a set of your own and a set of competitive brands/SKUs across a set of targeted retailers and geographies.