Actionable route-to-market pricing and penetration game plans that restore profitable CPG brand growth.

It’s getting tougher to get on, and stay on the shelf

Lower- and middle-market CPG brands face crushing shelf and spend competition from larger brands in today’s uncertain inflationary and stressed shopper environment.

Furthermore, escalating costs and portfolio complexity are pressurizing margin viability.

With pricing headwinds and volume challenges exposing profit vulnerabilities, finding sustainable route-to-market growth opportunities is mission-critical.

Empower your executive team to build profitable brands

UpScalability supports brand growth by pinpointing the where-to-play and how-to-win strategic choices and trade-offs for each route-to-market channel.

By providing a tailored, data-driven, financial-impact approach, we enable executive teams and their VC/PE investors to drive sustainable, profitable growth — even in the most challenging market conditions.

What is driving your core brand growth for 2025 -2028?

UpScalability, founded by Manoli Kulutbanis, is a boutique advisory firm specializing in helping CPG and consumer brands unlock pricing value and drive profitability growth across targeted go-to-market channels.

Develop and implement financially sustainable pricing and margin growth strategies that navigate complex competitive trade-offs and decision-making challenges.

Reduce the risk of failure by implementing a strategic operational and financial plan built on:

A thorough analysis of price points, profit margins, and bottom-up unit economics.

Realistic velocity targets aligned with the Net Sales growth trajectory you aim to achieve.

Strategic Growth Planning

Develop customized market opportunity maps and decision-making frameworks.

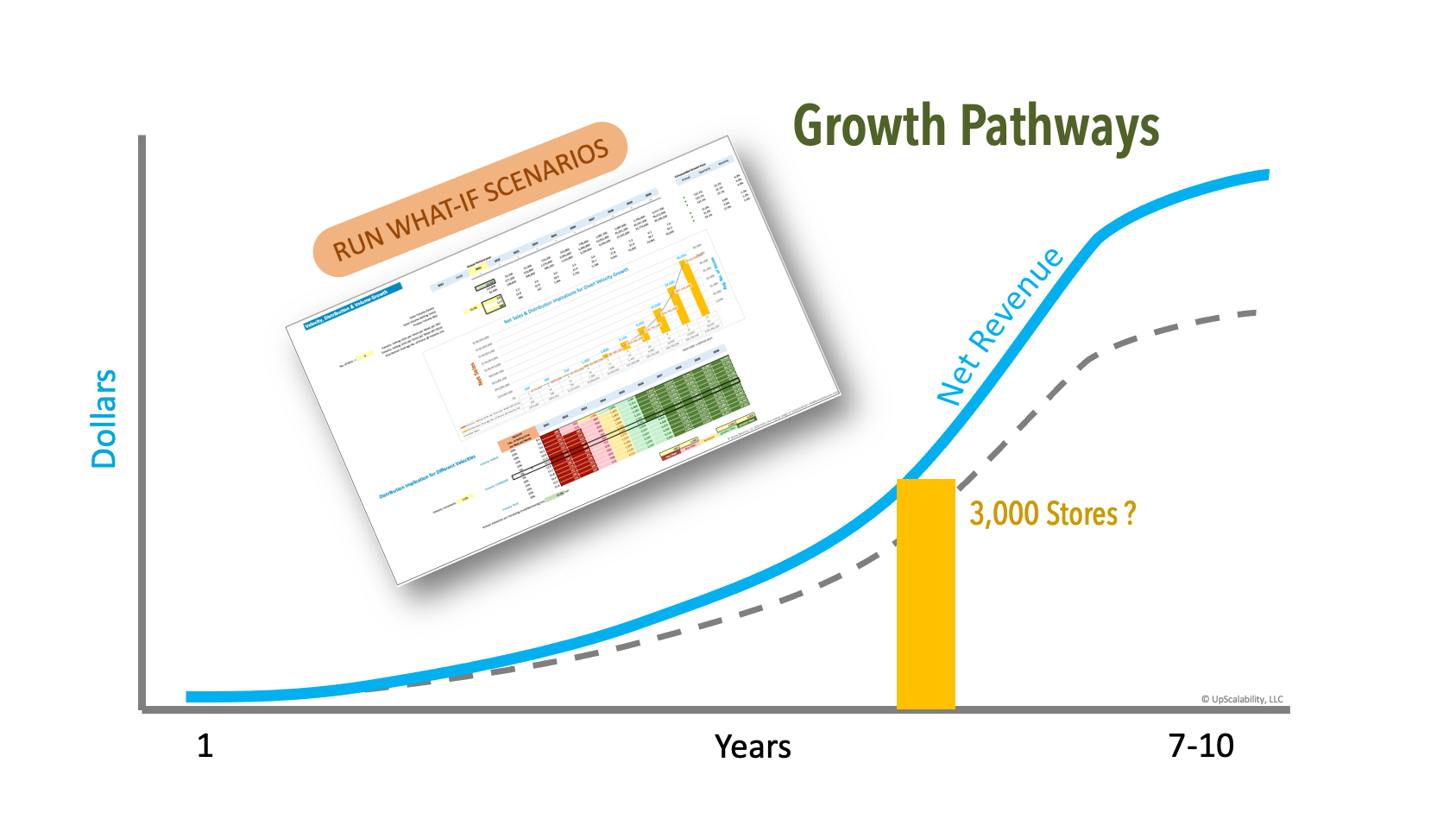

Model and compare competing financial growth pathways and scenarios.

Adopt constraint-based approaches to sales and operations planning (S&OP).

Margin Velocity Accounting (MVA)™

Unmask the direct margin impact of price, velocity and distribution reach changes.

Analyze and pre-empt competitive response capabilities and behaviors.

Stress-test budgets against pragmatic velocity and account growth hurdles.

Margin Velocity Planner (MVP)™

Determine the appropriate trade marketing expense mix and levels for a brand and SKU.

Build the unit economics for different price-points using a fact-based, bottom-up approach.

Set realistic, achievable velocity-based growth and distribution roll-out targets.

A comprehensive 4-month program designed to build skills and insights through a blend of self-guided mini-lessons and personalized one-on-one advisory support.

This program empowers sales, marketing, and finance managers to confidently develop effective pricing strategies and margin growth plans tailored to different route-to-market channels.

Performance Guaranteed!